The risks arising from single bidder tenders in the UK

Ian Makgill from SpendNetwork and OpenOpps ran a twitter thread a few days ago based on a presentation he did on procurement data analysis.

Thread / I recently gave a presentation with @CivTechForum highlighting some of the key issues in public procurement. I thought I'd run through some of those issues here. Please R/T. pic.twitter.com/15xVj62YGJFebruary 23, 2018

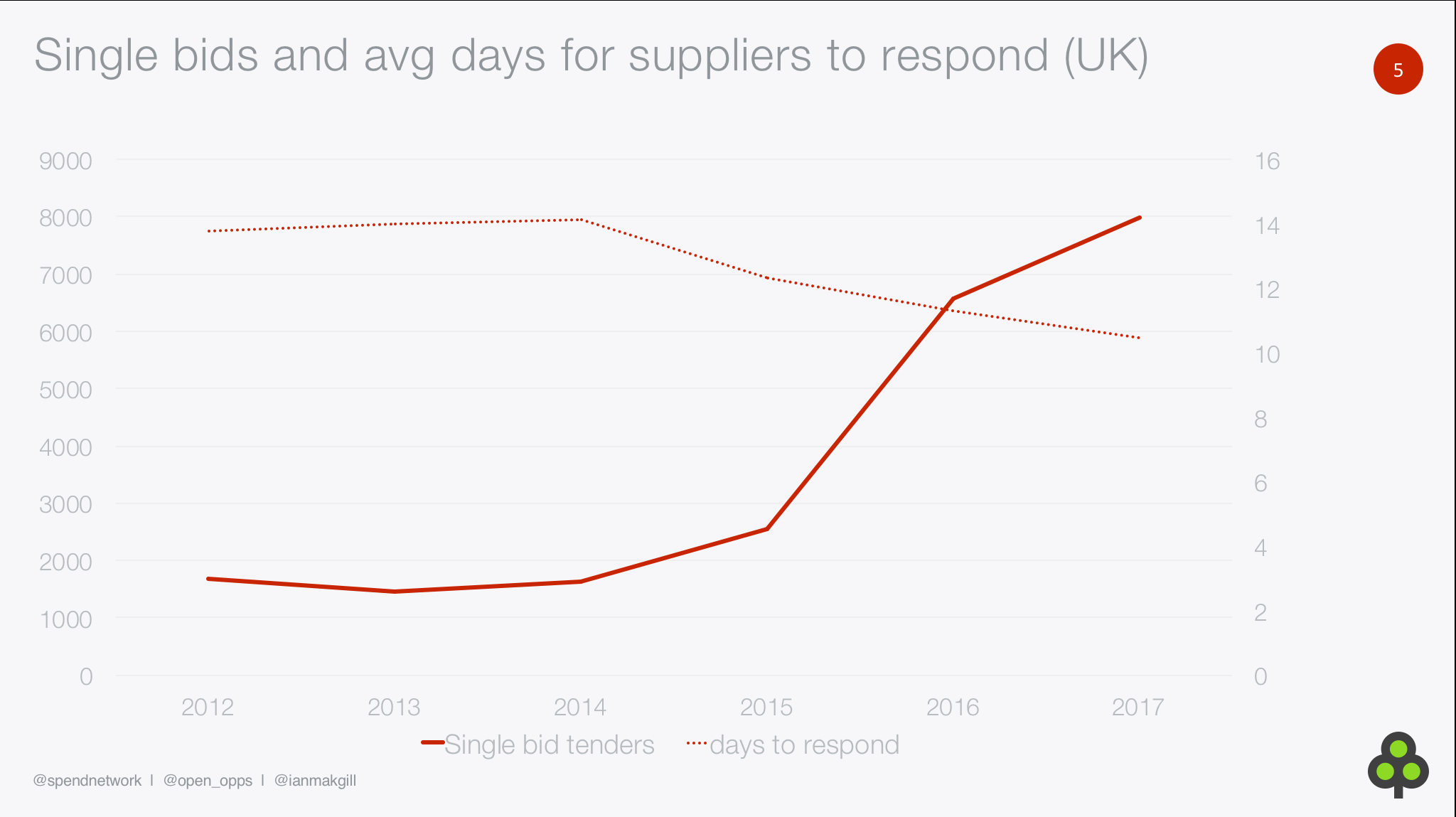

The whole thread is worth reading and Ian was kind enough to send around the slide deck. One of the slides immediately captured my attention:

It seems that from 2015 onwards there has been an increase in the total number of single bid tenders in the UK as well as a decrease in the average number of days for tenders to be submitted. As far as I can tell, Ian is implying both are correlated since the Public Contracts Regulations 2015 allow for shorter timescales to submit tenders. On another slide he argues a total increase of single bid tenders of 476% since 2012 and that is visible on the slide above as well. There is a clear trend for 2016 and 2017 which is markedly different from the years prior to 2015.

It is unclear how the increase is distributed, ie if the increase is happening across the board or if it is concentrated around specific characteristics, such as sector, project complexity or choice of procedure. It may be that, for example, in large/complex contracts the reduction in timescales affects them more than smaller contracts or the opposite - it is in the smaller contracts that the very short turnaround times really impact competition.

Single bid tenders are problematic for competition since they imply an absence of real competition during the procedure. The Economist had already pointed out in late 2016 the decrease in competition for public contracts. Lack of competition is bad by itself on a traditional open or restricted procedure but potentially much more problematic on any procedure with negotiations or dialogue such as the competitive procedure with negotiation or the competitive dialogue.

For example, between March 2015 and January 2018 the competitive procedure with negotiations was used 458* times in the UK. It may have displaced some use of competitive dialogue (502 contract notices in the same period) but I suspect most of the substitution happened with the restricted (6,467) and open procedures (22,428) since they remain the 'standard' procedures. I would love to see how likely it is for the competitive procedure with negotiation and competitive dialogue to end up with a single bidder. However, for now a change in procedural practice does not seem to hold the smoking gun.

There are a couple of additional potential explanations for Ian's finding in addition to his implied justification of reduced timescales. At this moment I don't think either of them fully explains what Ian found. The first is an increase in pre-market engagement which has long been touted as a "great" idea for public procurement. The second is a negative competition externality arising from the increase in transparency in contract award information.

Regarding pre-market engagement, it is now clearly allowed in Regulation 40 (Preliminary market consultations) for the contracting authority to engage with conversations with potential bidder(s) before launching an official tender. I have had reservations about the negative impact of said conversations on competition and guaranteeing a level playing field in the subsequent tender procedure. Combined with the shorter timescales for tender submission, any bidder with advance information about the contract will be in a better position than the competition to participate.

As for the second, the argument in competition law circles goes that the more information you give to the market, the easier it is for cartels to collude. Overall this idea is not to be disputed but I find it unlikely we would observe in the data such a quick increase in collusion immediately after the new rules came into being. Especially as contract award data is still patchy and not really easy to parse.

How do we go about checking the reasons behind this sudden increase in single bid tenders? First, I think we need to narrow down on which sector/types of contracts this is really happening. Then we need to test those hypothesis and there are a few (non-robust) ways of going about to do so. Comparing with the previous status quo (ie, what was happening with contracts before the legal change) and comparing with other EU Member States where this data is reliably collected like Portugal or Slovakia. Portugal has just transposed the Directives so the reduction in timescales is effective only from January 1st onwards. And while the country publishes a monthly summary of procurement data, the monthly report does not include any information about the number of bidders whereas the larger yearly one does.

* I used data directly from the TED which mostly covers contract above tje EU financial thresholds and as such is a lot less complete than Ian's.